The 9-Minute Rule for Summitpath Llp

The 9-Minute Rule for Summitpath Llp

Blog Article

Our Summitpath Llp PDFs

Table of ContentsSummitpath Llp for BeginnersThe smart Trick of Summitpath Llp That Nobody is Talking AboutLittle Known Facts About Summitpath Llp.The Of Summitpath Llp

Most lately, launched the CAS 2.0 Method Advancement Coaching Program. https://www.find-us-here.com/businesses/SummitPath-LLP-Calgary-Alberta-Canada/34309676/. The multi-step coaching program consists of: Pre-coaching alignment Interactive group sessions Roundtable conversations Embellished coaching Action-oriented mini intends Companies aiming to expand into advising solutions can also transform to Thomson Reuters Method Onward. This market-proven approach provides web content, tools, and support for companies curious about advisory servicesWhile the modifications have unlocked a number of growth possibilities, they have actually also resulted in obstacles and issues that today's companies need to have on their radars., firms must have the capacity to quickly and effectively perform tax obligation study and improve tax obligation reporting effectiveness.

Driving greater automation and ensuring that systems are securely integrated to streamline workflows will help minimize bandwidth issues. Companies that continue to run on siloed, heritage systems risk shedding time, cash, and the trust of their customers while increasing the possibility of making mistakes with manual entrances. Leveraging a cloud-based software program service that works effortlessly with each other as one system, sharing data and processes across the company's workflow, can show to be game-changing. Furthermore, the brand-new disclosures might bring about a boost in non-GAAP steps, traditionally an issue that is very scrutinized by the SEC." Accountants have a whole lot on their plate from regulatory changes, to reimagined business models, to a boost in customer expectations. Equaling it all can be difficult, yet it does not have to be.

The Of Summitpath Llp

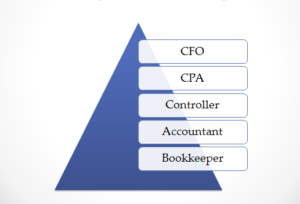

Listed below, we define 4 CPA specialties: taxes, management bookkeeping, monetary coverage, and forensic accounting. Certified public accountants concentrating on tax assist their clients prepare and submit income tax return, minimize their tax problem, and prevent making errors that might lead to expensive charges. All CPAs need some understanding of tax law, however concentrating on taxation suggests this will certainly be the emphasis of your job.

Forensic accountants typically begin as basic accountants and move into forensic bookkeeping functions gradually. They need strong logical, investigatory, business, and technological audit skills. CPAs who specialize in forensic audit can sometimes go up right into management audit. Certified public accountants require at least a bachelor's level in bookkeeping or a similar field, and they should finish 150 credit scores hours, including accountancy and business classes.

No states require a graduate degree in bookkeeping. An accountancy master's level can aid students satisfy the CPA education and learning need of 150 credit reports given that the majority of bachelor's programs only call for 120 credit ratings. Bookkeeping coursework covers subjects like financing - https://www.ted.com/profiles/49691580, auditing, and taxes. As of October 2024, Payscale reports that the average yearly salary for a certified public accountant is $79,080. Calgary Accountant.

Bookkeeping also makes functional sense to me; it's not just theoretical. The Certified public accountant is a crucial credential to me, and I still obtain continuing education credit scores every year to keep up with our state requirements.

Unknown Facts About Summitpath Llp

As an independent consultant, I still utilize all the fundamental foundation of accountancy that I found out in college, seeking my certified public accountant, and operating in public accounting. One of things I actually like about audit is that there are several work readily available. I determined that I desired to begin my job in public accountancy in order to learn a whole lot in a brief period of time and be subjected to different kinds of customers and various areas of audit.

"There are some work environments that do not wish to consider somebody for an accountancy function that is not a CPA." Jeanie Gorlovsky-Schepp, CPA A certified public accountant is a very beneficial credential, and I wished to place myself well in the marketplace for various tasks - Calgary CPA firm. I made a decision in university as an audit significant that I wished to attempt to get my CPA as soon as I could

I have actually fulfilled lots of wonderful accountants who do not have a CERTIFIED PUBLIC ACCOUNTANT, however in my experience, having the credential actually assists to advertise your knowledge and makes a distinction in your compensation and profession alternatives. There are some offices that don't wish to consider someone for an accountancy role who is not a CERTIFIED PUBLIC ACCOUNTANT.

A Biased View of Summitpath Llp

I actually delighted in functioning on various kinds of tasks with different customers. In 2021, I made a decision to take the next step in my audit profession journey, and I am currently a self-employed accounting consultant and organization consultant.

It remains to be a development location for me. One crucial top quality in being a successful CPA is really caring about your clients and their companies. I like collaborating with not-for-profit clients for that extremely reason I feel like I'm actually adding to their objective by helping them have great monetary details on which to make clever organization decisions.

Report this page